Besides the tax-deferred benefits, fixed annuities offer many other advantages such as:

Tax-deferred growth allows your money to grow faster because you earn interest on dollars that would otherwise be immediately taxable. Paying taxes on gains each year will reduce the amount of funds available for growth and compounding. With a tax-deferred annuity your earnings will accumulate on both your principal and interest which results in greater value buildup over time.

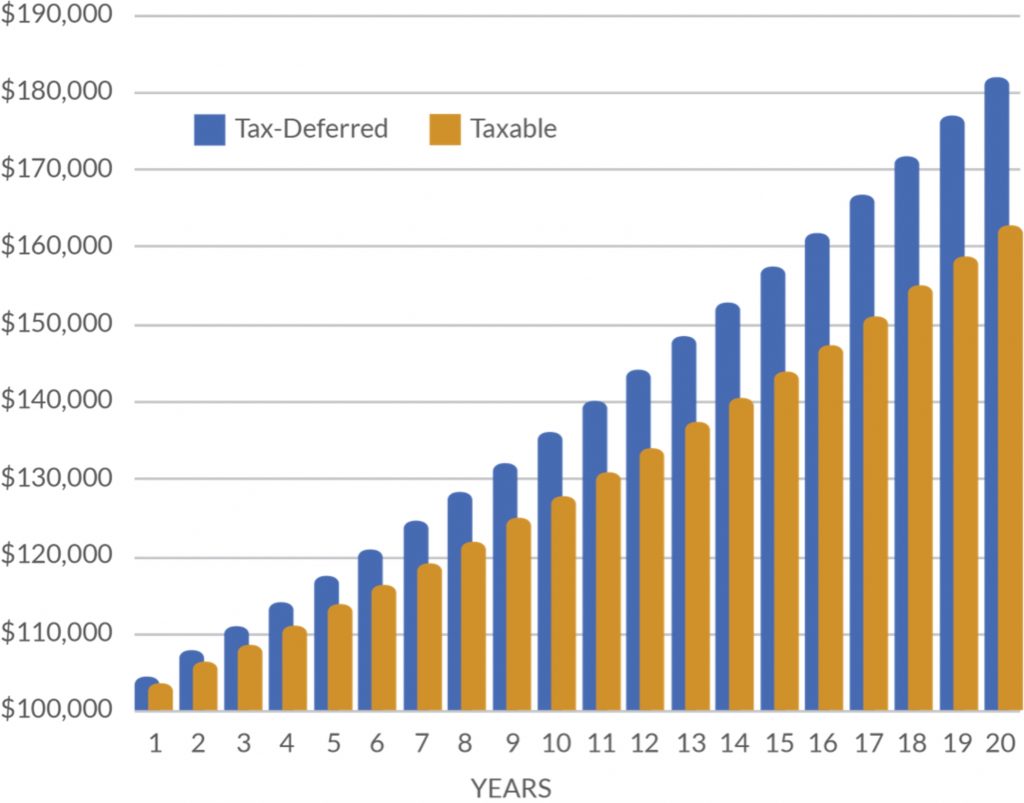

Income taxes are deferred until funds are withdrawn from the contract. The chart below shows the comparison of tax-deferred versus taxable growth over a 20-year time horizon.

In the example, an initial premium of $100,00 is shown growing over a 20-year period using a 3.00% interest rate. This compares the difference in growth of a tax-deferred growth to taxable growth, assuming no withdrawals are taken.

How much premium does it take to open an annuity?

CL Life annuities can be opened with just $10,000.

Can I add money to my annuity?

CL Life annuities are single premium, meaning no additional premium may be added. You are able to own more than one CL Life annuity, so additional monies can be used to purchase another CL Life annuity.

How does the death benefit work?

Upon death the full accumulation value is paid to the beneficiaries that you have named in your contract. If you have named your spouse as the primary beneficiary, they have the ability to keep the contract and continue it in their name.

Do I have access to my money?

Yes, the penalty-free withdrawal feature will vary depending on the product you purchased. You are also able to start an income stream for a specific period of time or for your lifetime through the annuitization benefit.

What happens if I decide I do not wish to keep my annuity after I open it?

You have a 30-day window in which you can return the annuity and receive 100% of your premium back.

What happens at the end of my interest rate guarantee period?

You will receive a renewal notice from CL Life that provides your options. During the 30 days following the current interest rate guarantee period you may:

Can I take my Required Minimum Distribution from my IRA?

Absolutely, CL Life will allow you to take your Required Minimum Distribution penalty-free even if the amount required is greater than the penalty-free available at the time.

What types of tax-qualified money can I bring to fund my annuity?

CL Life annuities will support traditional IRAs and Roth IRAs only. If you have other types of plans please consult your tax advisor for other options.

You will receive a renewal notice from CL Life that provides your options. During the 30 days following the current interest rate guarantee period you may:

New to annuities? We have provided a glossary of terms to help you understand the terminology and definitions surrounding annuities.